The Saudi Landbridge Project 2026 has become one of the most closely watched infrastructure initiatives in the Kingdom. As risks in the Red Sea persist, Saudi Arabia is accelerating a land-based solution to protect trade flows. The Landbridge railway, linking Red Sea ports to the Arabian Gulf, is now central to logistics planning. New tenders and capacity bookings signal a clear shift from trucks and ships to rail.

This project is no longer just a long-term vision. It is an active response to real supply chain stress.

Why the Saudi Landbridge Project 2026 Matters Now

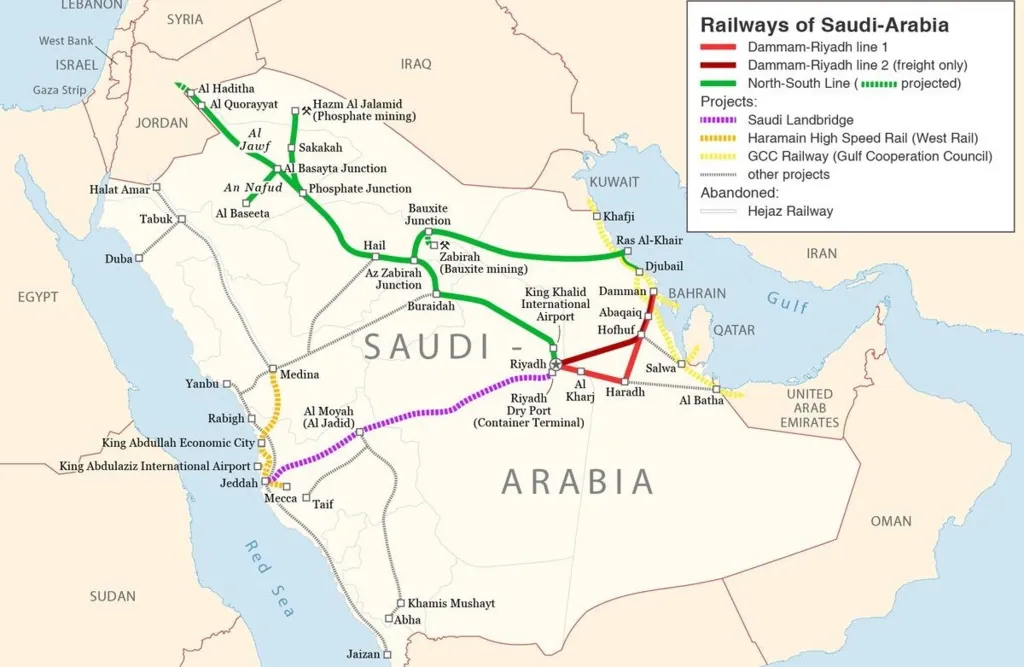

The Landbridge is designed to connect ports such as Jeddah on the Red Sea to Dammam on the Gulf. It bypasses maritime choke points that have become unreliable due to ongoing security risks.

The rail corridor spans more than 1,500 kilometers, including a 900 km Riyadh–Jeddah line. Total investment stands at $7 billion. Construction began in 2025, with operations targeted for the late 2020s.

Once operational, the railway is expected to move over 50 million tons of freight per year. This would transform cross-kingdom logistics and reduce dependence on sea routes.

Read Also: Saudi Logistics Tech Scales Toward $6B Autonomy

Read Also: Saudi Arabia’s $100B Smart Logistics Push Is Rewiring the Global Supply Chain

Saudi Landbridge Project 2026 and the Shift to Rail

One of the core goals of this landbridge project is shifting freight from trucks to trains. Rail offers lower costs per ton, higher reliability, and better fuel efficiency.

Recent tenders focus on the Riyadh Rail Link and upgrades to the 115 km Dammam–Jubail line. These improvements will allow container trains to cross the kingdom in under 10 hours.

The project also supports the development of nearly 20 modern logistics hubs along the corridor. Seven logistics centers alone will stretch from Yanbu to Riyadh, strengthening Saudi Arabia’s national logistics performance.

Heavy Industry Pre-Books Rail Capacity for 2026

A major signal of confidence is coming from heavy industry. Manufacturing, petrochemicals, and large exporters are already pre-booking rail freight capacity for 2026.

Their goal is simple. Avoid maritime delays. Reduce exposure to Red Sea risks. Secure predictable delivery times.

With annual capacity exceeding 50 million tons, rail-linked industrial parks are emerging near key stations. Companies are prioritizing reliability over traditional sea routes, even if it means reworking supply chains inland.

This trend is accelerating intermodal warehousing and cargo throughput at rail nodes across the Kingdom.

Economic Impact and Logistics Growth

Officials project $4.2 billion in annual transportation cost savings once the Landbridge is fully operational. The project is also expected to create around 200,000 jobs.

By 2035, logistics services tied to the corridor could generate $3-4 billion in annual economic output. This aligns directly with Vision 2030 goals to position Saudi Arabia as a global logistics hub.

Read Also: Saudi Port Expansion & Maritime Logistics Growth Under Vision 2030

Funding blends government resources with international partners, ensuring both scale and long-term viability.

What the Saudi Landbridge Project 2026 Signals for Investors

The message of this article is clear. Infrastructure decisions are being driven by risk management, not convenience. And rail is becoming the backbone of Saudi freight movement.

The Saudi Landbridge Project 2026 shows how logistics strategy is adapting to global disruptions. Companies that understand this shift early gain a clear advantage. To explore how your business can navigate logistics transformation, infrastructure trends, and market dynamics in Saudi Arabia, contact Saudi Arabia Logistics by Eurogroup Consulting. With 40 years of distinguished experience, Eurogroup Consulting excels in strategic consulting and market research across the region, helping clients succeed in Saudi Arabia’s rapidly evolving market landscape.