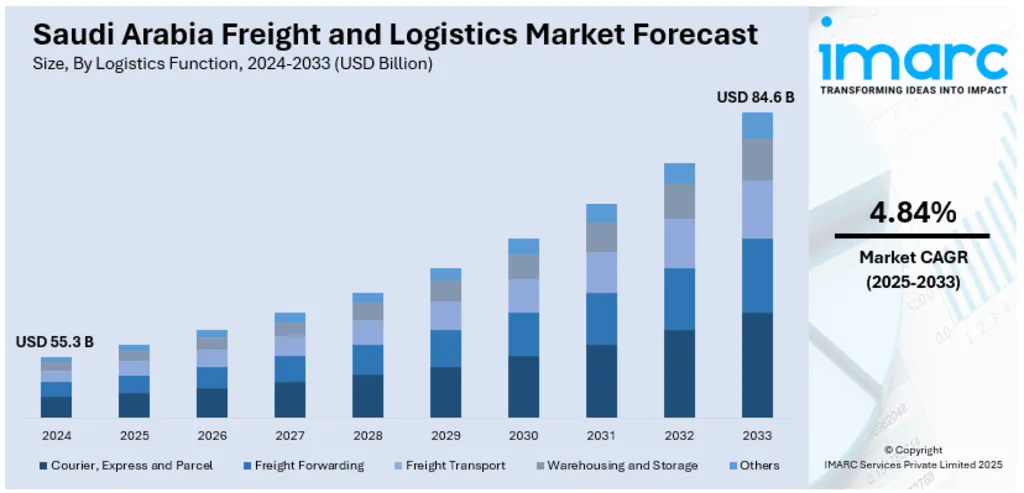

Saudi Logistics Infrastructure by 2033: Smart Corridors Unlock $84.6B Trade Potential

Saudi Arabia’s freight and logistics market is projected to reach USD 84.6 billion by 2033, growing at a CAGR of 4.84%. This growth is fueled by the expansion of logistics corridors that connect key industrial zones, ports, and urban centers. These corridors streamline the movement of goods across sectors like agriculture, construction, and mining. The Northern and Central Region, anchored by Riyadh, benefits from strategic road upgrades that support manufacturing and retail. Meanwhile, the Eastern Region’s oil and gas dominance is reinforced by freight routes linking Dammam’s King Abdulaziz Port to inland refineries and industrial hubs.

Bonded Zones and Mega Projects: 100,000 sqm Facility at Ras Al-Khair

Bonded zones are emerging as critical nodes in Saudi Logistics Infrastructure, offering customs advantages and multimodal connectivity. These zones support high-volume trade and reduce bottlenecks for industries like energy, manufacturing, and e-commerce. In November 2024, GWC partnered with Offshore Fabrication Company to build a 100,000 sqm logistics facility at Ras Al-Khair Port. This development enhances energy supply chains and supports customer-centric operations. Similarly, Jeddah Islamic Port’s 225,000 sqm logistics park, launched by Maersk in August 2024, integrates sea, land, and air transport with climate-controlled warehousing and last-mile delivery services.

Digital Tracking Systems: AI Spend to Hit $1.9B by 2027

Saudi Arabia’s Vision 2030 is accelerating digital transformation across logistics. AI, IoT, and blockchain are reshaping how goods are tracked, stored, and delivered. According to the International Trade Administration, AI expenditure in the Kingdom is expected to exceed $720 million in 2024 and reach $1.9 billion by 2027, with 50% allocated to interpretative AI. These technologies enable predictive analytics, real-time inventory management, and route optimization. Companies like Mile Solutions and Premium Shipping are automating fulfillment and delivery processes across cold chain and standard warehouse facilities, enhancing speed and reliability.

Regional Integration: Western and Southern Regions Expand Cold Chain and Mining Logistics

The Western Region, home to Jeddah and Makkah, leverages its Red Sea access to support tourism and trade. Logistics providers ensure the smooth flow of goods for millions of Hajj and Umrah pilgrims. In the Southern Region, agricultural exports and mining activities depend on cold chain systems and improved road connectivity. Freight services here are tailored to preserve perishables and transport minerals like gold and bauxite to domestic and international markets.

Strategic Alliances: CEVA, DB Schenker, and Aramex Scale Saudi Logistics Infrastructure

Major players are investing in Saudi Logistics Infrastructure through joint ventures and regional headquarters. CEVA Logistics and Almajdouie Logistics signed a JV in July 2024 to deliver end-to-end solutions across the Kingdom. DB Schenker partnered with Kaden to develop custom-designed warehouses in Jeddah. Aramex opened a new regional HQ in Riyadh in March 2024, reinforcing its commitment to innovation and supporting Vision 2030’s digital goals. These collaborations reflect a broader trend of integrating global expertise with local capabilities to meet rising demand across sectors.

Also Read: Saudi Port Expansion & Maritime Logistics Growth Under Vision 2030