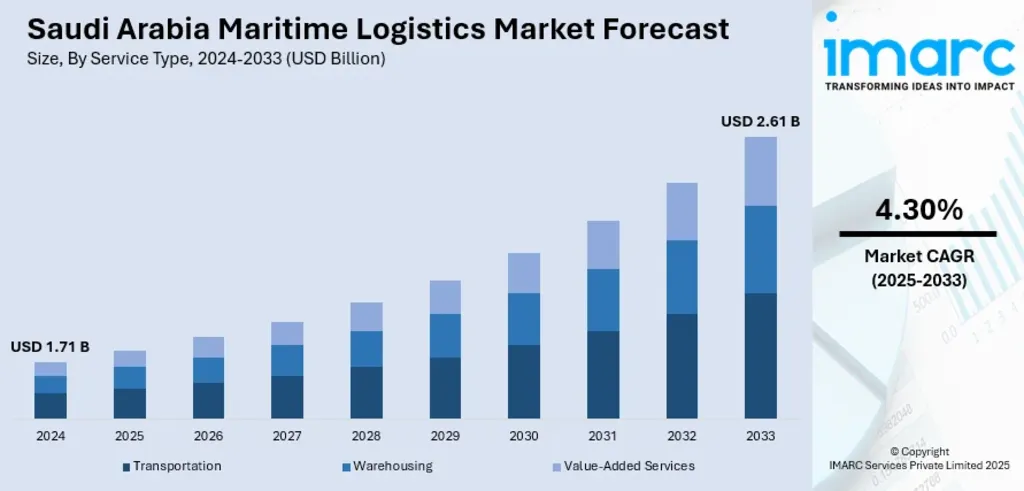

Market Size: USD 1.71 Billion in 2024, Forecast to USD 2.61 Billion by 2033

The Saudi Port Logistics market is on a steady upward trajectory. Valued at USD 1.71 billion in 2024, the sector is projected to reach USD 2.61 billion by 2033, expanding at a 4.3% CAGR between 2025 and 2033. This growth reflects not only the Kingdom’s strategic investments in infrastructure but also its ambition to transform into a global logistics hub under Vision 2030.

Infrastructure Investment Driving Saudi Port Logistics

Saudi Arabia’s maritime logistics industry is undergoing a structural transformation fueled by government-backed infrastructure projects. The development of King Abdullah Port and the expansion of Jeddah Islamic Port are central to this strategy, enhancing the Kingdom’s maritime capacity and competitiveness.

Beyond physical expansion, the government is prioritizing automation, digital logistics, and sustainable practices to reduce costs and improve efficiency. The upcoming 2nd International Port & Marine Development Conference (IPMDC 2025) in Jeddah underscores this commitment, bringing together global experts to discuss sustainable port infrastructure and digital transformation.

By aligning infrastructure upgrades with Vision 2030, Saudi Port Logistics is positioned to strengthen supply chains, attract foreign investment, and elevate the Kingdom’s role in global trade.

Strategic Location Boosts Regional Trade and Connectivity

Saudi Arabia’s geographic advantage—situated at the crossroads of Europe, Asia, and Africa—is a powerful driver of maritime logistics growth. Its ports along the Red Sea and Arabian Gulf serve as vital transit hubs for international shipping lanes.

The government’s National Transport and Logistics Strategy further amplifies this advantage by fostering global partnerships. A notable example is the 2025 launch of MSC’s “Clanga” shipping service at Jubail Commercial Port, which connects Saudi Arabia with major East Asian markets such as Singapore, Shanghai, and Colombo. This service strengthens export competitiveness and reinforces the Kingdom’s ambition to become a global logistics hub.

Cargo Throughput Rises 8.6% to 22.52 Million Tonnes in September 2025

The operational performance of Saudi ports reflects the success of these strategies. In September 2025, ports handled 22.52 million tonnes of cargo, an 8.6% increase year-on-year. This included:

- 1.22 million tonnes of general cargo

- 5.7 million tonnes of dry bulk

- 15.6 million tonnes of liquid bulk

Such growth highlights the resilience of Saudi Port Logistics in supporting trade, tourism, and food security while advancing Vision 2030’s connectivity goals.

Vessel Traffic and Passenger Growth Strengthen Logistics Ecosystem

Maritime traffic also recorded gains, with 1,001 vessels docking in September 2025, up 1.11% from the previous year. Passenger numbers surged by 58.56%, reaching 71,376 travelers, underscoring the expanding role of ports in tourism and regional mobility.

While vehicle imports fell by 20.09% and livestock shipments declined by 17.07%, these shifts reflect evolving trade patterns rather than structural weaknesses. The broader logistics ecosystem remains robust, supported by rising cargo volumes and diversified port services.

Container Activity: Mixed Trends but Strong Transshipment Growth

Container handling presented a nuanced picture. Total throughput fell by 2.75% to 654,865 TEUs in September 2025 compared to the previous year. Exported containers dropped by 7.14%, while imports declined by 3.02%.

However, transshipment containers rose 4.74% to 166,791 TEUs, signaling Saudi Arabia’s growing importance as a regional redistribution hub. The momentum was even stronger in August 2025, when ports handled 750,634 TEUs, a 9.52% increase year-on-year, driven by a 14.7% surge in transshipment activity.

This trend underscores the Kingdom’s ability to leverage its geographic position to capture regional trade flows, even amid fluctuations in direct import and export volumes.

Saudi Port Logistics Positioned for Global Competitiveness

The combination of USD 1.71 billion market size in 2024, rising cargo throughput, and strategic infrastructure investments paints a clear picture: Saudi Port Logistics is evolving into a cornerstone of the global supply chain. By integrating digital transformation, sustainable practices, and international partnerships, the Kingdom is not only diversifying its economy but also cementing its role as a logistics powerhouse connecting three continents.

Also Read: Transforming Trade: Saudi’s Transport and Logistics Strategy