Saudi Arabia Logistics Growth Trends up to 2030

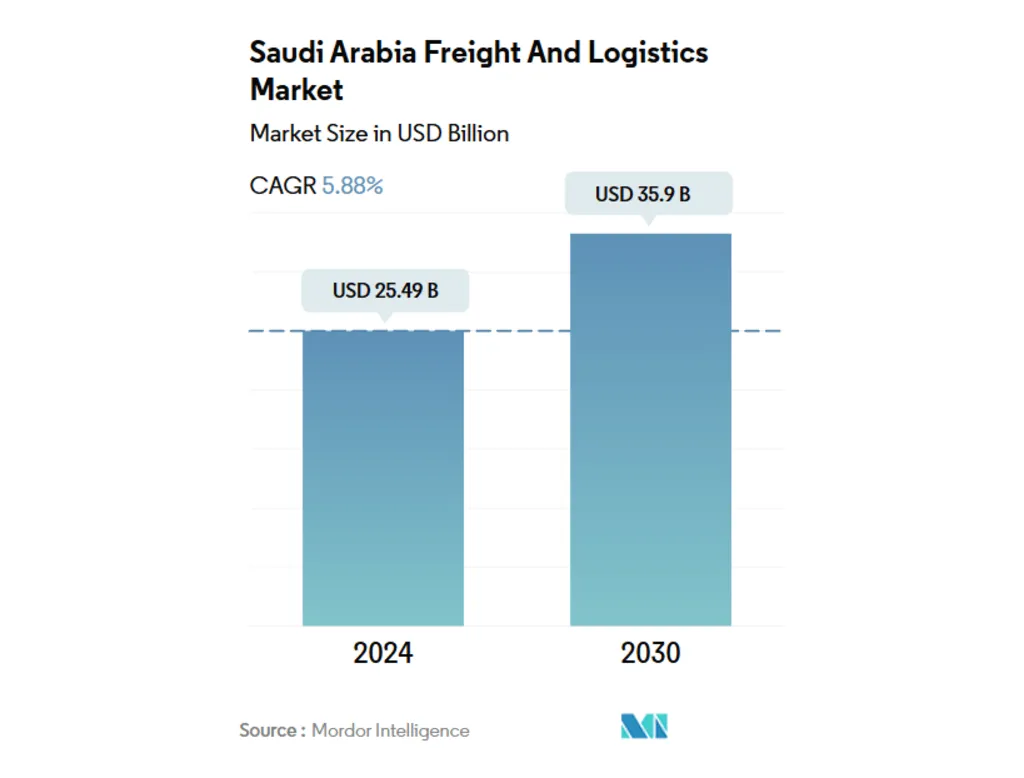

The Saudi Arabia Freight and Logistics Market is set for a remarkable expansion, propelled by strategic investments and the visionary Saudi Vision 2030 initiative. This market is anticipated to expand significantly, with an estimated size of USD 25.49 billion in 2024, projected to reach USD 35.9 billion by 2030, reflecting a compound annual growth rate (CAGR) of 5.88% during this period. In the insights derived from the expert team at our Saudi logistics Consulting, we highlight the dynamic evolution of the logistics sector within the Kingdom.

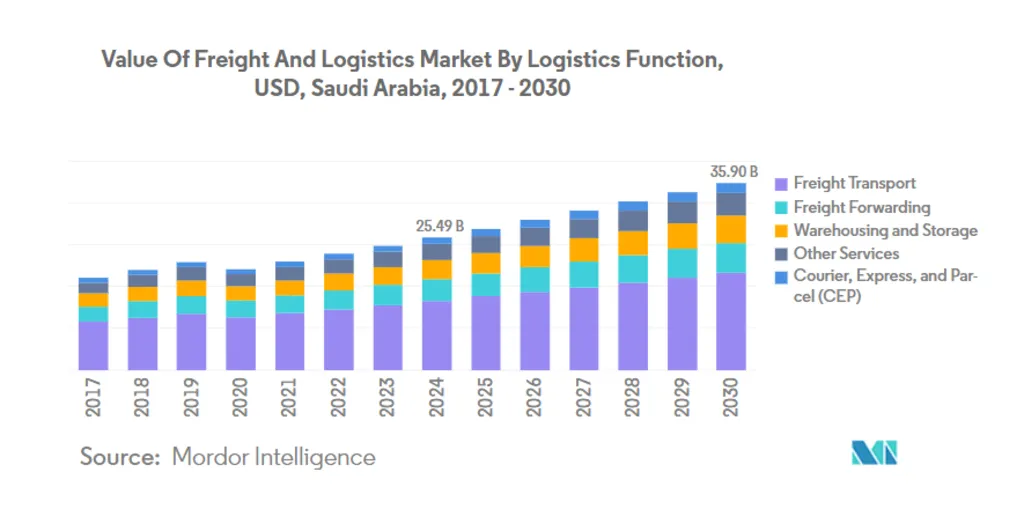

Market Segments and Insights

The Saudi logistics market is divided into various end-user industries, including agriculture, construction, manufacturing, oil and gas, mining and quarrying, and wholesale and retail trade. Each sector contributes significantly to the market’s overall growth.

Freight Transport and Mode of Transport

A prominent segment within the Saudi logistics market is freight transport. Air freight is the fastest-growing segment, with a projected CAGR of 7.14% from 2024 to 2030. This growth aligns with the ambitious plans to transform Riyadh Airport into a major logistics hub with six runways, as part of the broader Vision 2030 objectives. The domestic logistics segment also stands out, holding a value share of 65.48% in 2023, driven by the thriving e-commerce sector, which grew by over 13% year-over-year in the same period.

End-User Industry Dynamics

The wholesale and retail trade sector is the largest end-user segment, commanding a value share of 30.88% in 2023. This is closely linked to the rapid growth of the Saudi e-commerce industry, which is expected to grow at a CAGR of 13.47% between 2023 and 2027. This growth significantly supports the expansion of the end-user industry, driving demand for logistics services.

Temperature Control Segments

In terms of temperature control, non-temperature-controlled logistics is the largest segment, accounting for a value share of 78.16% in 2023. However, the temperature-controlled segment is the fastest-growing, with a projected CAGR of 6.79% from 2024 to 2030. The year 2023 saw a notable increase in cold storage construction, highlighted by Sadr Logistics Company’s announcement of a USD 39.72 million logistics complex in Riyadh.

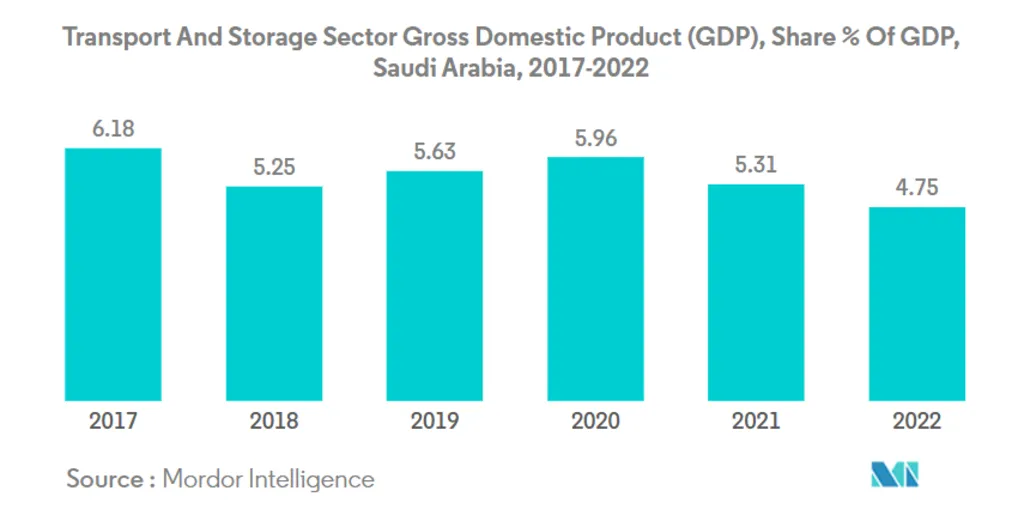

Infrastructure Investments and Strategic Developments

The Saudi government is heavily investing in the country’s logistics infrastructure. In 2023, SAR 40 billion (USD 10.6 billion) was allocated for road network enhancements, including four highway projects under the Public-Private Partnership (PPP) model. These efforts are part of a broader USD 147 billion plan to develop the transportation and logistics sector, transforming Saudi Arabia into a global logistics hub.

Maritime and Multimodal Transportation

Saudi Arabia’s maritime fleet has seen significant growth, with 368 tankers and ships boasting a total capacity of 13.5 million tons. This robust fleet underscores the Kingdom’s leadership in global maritime transport, which underpins 90% of global trade. Additionally, the planned GCC railway, a USD 15.5 billion project, will enhance regional connectivity, managing up to 29 million tons of goods annually.

Challenges and Opportunities

The logistics sector faces challenges such as fluctuating oil prices and global economic uncertainties. Despite these challenges, the Saudi logistics market remains resilient, supported by strategic investments and policy reforms aimed at diversifying the economy. For stakeholders, it is essential to leverage these insights to navigate the market’s complexities and capitalize on emerging opportunities within Saudi logistics. Our Saudi logistics Consulting team is equipped with the expertise and resources to help you understand these trends, develop strategic plans, and implement solutions that drive growth and efficiency in your logistics operations.