Introduction

Foreword

This white paper invites us to step out of our daily lives and understand the major forces that are transforming our environment and to grasp and interpret the changing dynamics of globalization. Describing the meteoric rise of China's role in value chains today is a good way of putting things into perspective: those that understood early on that opportunities were there to be captured and positioned themselves early-on for success are, indeed, those that benefited most greatly.There are economic transformations that are slow on the scale of a man’s life and there are those that are dramatic changes with rapid acceleration. Some of the world may see the Gulf Cooperation Council (GCC) economies as primarily oil- based but these countries have been actively positioning themselves differently and harnessing their maximum potentials across a range of diversified industries. GCC governments are strong strategists and have understood that when it comes to economic transformation it is always good for logistics to come first.

Let’s not forget that this is a region at the crossroads of three continents: Asia, Europe and Africa. For centuries, this privileged position has led the Arabian Peninsula to participate in the construction of mythical components of the history of global supply chains: the caravans, the Red Sea ports, the warehouse cities rich with all the goods that have passed through: goods coming from Asia, Africa or Europe.

The region has an opportunity to build a new page in its logistics history. Supply chain transformation, now as ever, presents tangible rewards for those willing to understand market needs, respond accordingly and to harness current growth stories within the GCC.

Purpose of This White Paper

- Review challenges associated with supply chain efficiency

- Assess recent and upcoming developments in the GCC that can offer an opportunity for organizations to redesign and transform supply chains to make them an even better tool to improve performance

- Conclude with a discussion regarding change management and associated risks for organizations that may or may not seize these opportunities

Supply Chains as a Lever for Economic Transformation in the GCC

Supply Chains

Supply chains in companies remain a major challenge in creating value for their customers. Through the services they provide, availability, delivery time, reliability, they bring a very competitive dimension to the scope of work. For years, these supply chains have been facing the challenge of constantly redesigning themselves to adapt to the changing constraints that determine them. This may involve changes in corporate strategies, whether in terms of the opening of new markets, the launching of new products or the takeovers and mergers, etc. But these changes may concern other external destabilizing factors, which are numerous today, such as financial crises, pandemics, conflicts, emergence of new technologies etc. Therefore, effectively managing supply chain performance means maintaining a constant readiness for change. This involves balancing daily operations with more significant transformative efforts.

GCC Region

In the last two decades, GCC countries have experienced a rapid evolution, to become the Middle East and West Asia strategic center for commercial activitiy. The choice of the international companies to implement their regional headquarters in this specific zone was principally influenced by all the facilities that the countries, especially the KSA and the UAE, have developed. These facilities are characterized by the efficient and well-connected infrastructures that these countries have built, from ports/ airports to roads and other components in addition to the advantageous tax system that these countries offer. Today, the King Abdullah Port in Jeddah, KSA and the Port of Jebel Ali in Dubai, UAE are ranked among the best ports in the world (Jeddah #37 with 4.7 MTEUs and Jebel Ali, #12 with 15.3 MTEUs in 2021). Both ports allow Ultra Large Container Vessels (ULCV - +>20 000 TEUs).

Political Will Drives Supply Chain Transformations: 3 Key Trends

By acting on the creation and modernization of infrastructure, by modifying regulatory environments and trade agreements, political will creates profound opportunities for the transformation of supply chains in the GCC. Shared, regional, political will can be found in three key trends:

1. Anchoring Supply Chains Within Global Frameworks

GCC countries have built up attractive offers that allow them to become part of large global logistics chains. With investment capacity replenished by the recent rise in energy prices, policies to build transport, warehousing and data exchange infrastructures have intensified.

The implementation of new infrastructure projects in the region has intensified competition between countries, each with a vision to become global hubs. Key milestones include:

National Industrial Development & Logistics Program (NIDLP)

- Under Vision 2030

- 135 Billion USD devoted to logistics infrastructure

- Aims to transform Saudi Arabia into a leading industrial powerhouse and a global logistics hub

- Create and improve the performance of logistics hubs

- Improve the local, regional and international connectivity of trade and transport networks

Jebel Ali Port

- The largest Port in the Middle East

- 4 container terminals with a combined capacity of 22.4 Million TEU (by the completion of Terminal 4)

- Modern Container Freight Station (CFS) facility that provides a range of services such as Handling transshipment cargo, Rework/Consolidation operations, Cargo delivery, including Inter-Port Transfer, Internal Shifting, etc

- Jebel Ali Port offers the latest cool and cold storage facilities

Bahrain Global Sea-Air Hub

- Fastest sea/air terminal in the world

- Multimodal logistics hub connecting Bahrain International Airport and Khalifa Bin Salman Port (KBSP), a multipurpose cargo and cruise facility, which is operated by the Bahrain arm of APM Terminals.

- Reduced time and cost of logistics activities between the Port and the Airport

- Use of cutting-edge technology

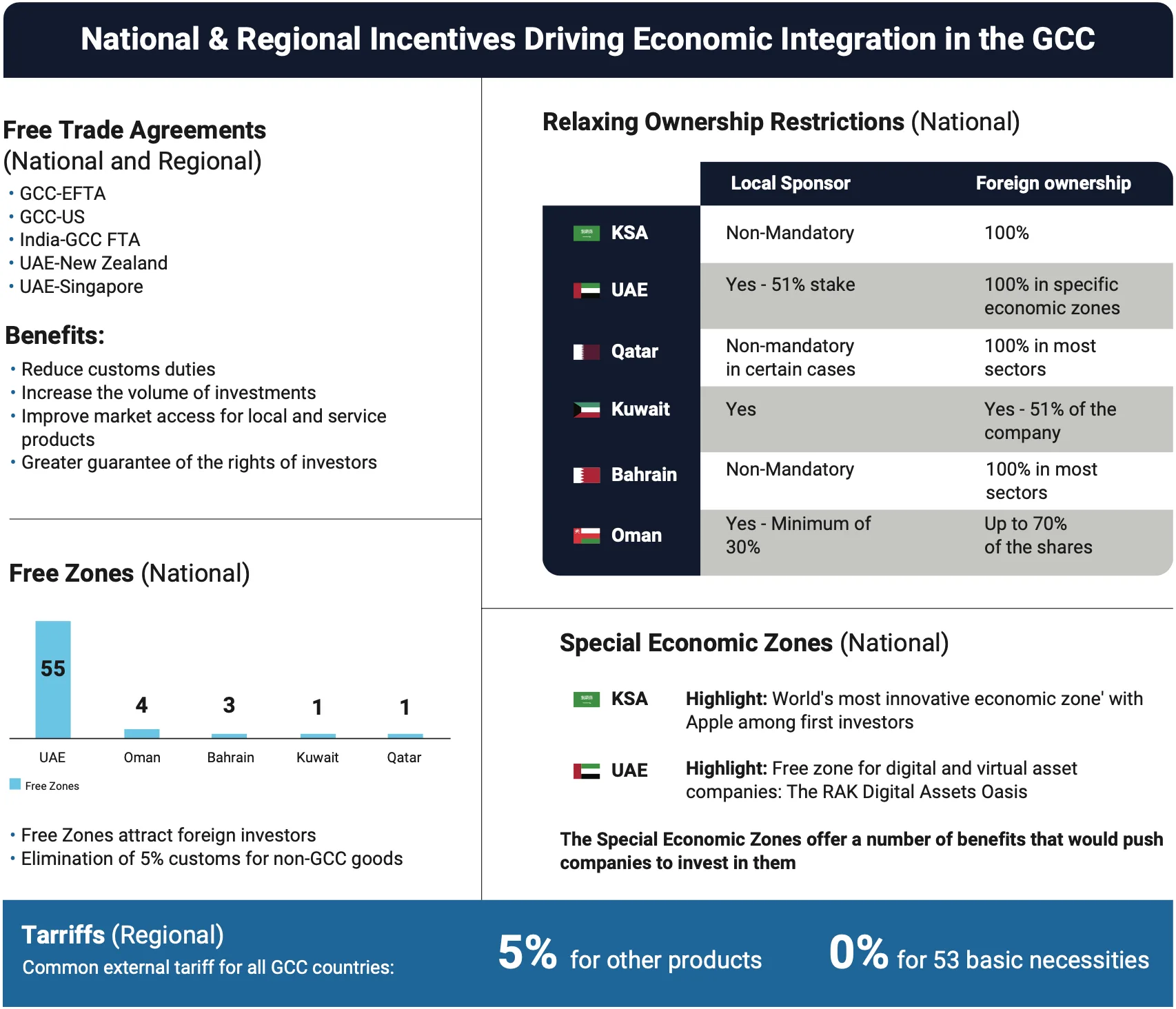

2. Creating the Conditions for Greater Integration

Despite the customs agreements, which are often bilateral and imperfectly enforced, the GCC countries remain loosely integrated economies. Commodity flows are still structured from a national perspective. Moreover, in many of these countries it was historically necessary to have a local sponsor with a certain percentage of a company’s capital in order to operate. Since companies have mainly a national scope, they have implemented a series of logistical solutions, each tailored to a particular country. Thus, the effects of regulations and fiscal frictions have made it more relevant to have a specific solution per country rather than a pooled solution at the regional level.

To attract business investment, GCC governments have used incentives, such as policy exemptions, the development of free zones or other incentives for local sourcing. The GCC landscape includes more than 55 free zones in the United Arab Emirates, four in Oman (Salalah, Sohar, Duqm, Al Mazunah), three in Bahrain, one in Kuwait (KTFZ) and one in Qatar. Saudi Arabia has recently paved the way for the development of Special Economic Zones (SEZs) and operates three bonded zones. Recently, Saudi also launched the ‘world’s most innovative economic zone’ with Apple among its first investors. The 5% customs tax for non-GCC goods is not applicable in those free zones.

In August 2023, Saudi Arabia doubled down on its commitment to make the Kingdom a global logistics hub and improve its competitiveness in terms of attracting investment. A new Logistics Master Plan was launched with the specific aim of developing the infrastructure of the logistics sector. The plan, part of a package of initiatives under the National Transport and Logistics Strategy (NTLS), stipulates that 59 logistics centers with a total area of more than 100 million square meters will be completed by 2030.

The GCC countries have signed free trade agreements (FTAs) with several countries and trade groups around the world, to strengthen its positioning as a global trade hub and major investment destination. In 2009, the free trade agreement between the GCC and the European Free Trade Association (EFTA) covered trade in goods, trade in services, government procurement, intellectual property rights, administration and dispute settlement, and competition. In 2012, a framework agreement on trade, economic, investment and technical cooperation was concluded between the United States and the GCC. The full impact of these FTAs has yet to be realized given the headroom for growth in the region.

The requirement of local sponsors in the boardroom is changing or disappearing across the region. The UAE has recently reformed its property laws to allow foreign ownership in specific commercial zones. In terms of customs regime, the common external tariff adopted among the GCC countries has two rates, one of 0% for 53 basic necessities (live animals, some fruits and vegetables, cereals, sugar) and another of 5% for all other products.

3. Intensify Supply Chains and Increase Their Maturity Through the Development of Local Production

Excluding hydrocarbons and raw materials, GCC countries have historically been import dependent with very small local manufacturing footprints. The share of manufactured products in exports represents less than 10% in each of these countries, whereas this figure is 68% on average, at the global level. Supplies of raw materials, components, semi-finished products, inter-factory flows, and flows of industrial ecosystems (maintenance, spare parts, tools, etc.) are reduced and supply chains weakened.

However, regional economies are now doing more to increase the maturity of their manufacturing sectors. In Saudi Arabia, manufacturing is one of the four key sectors, along with energy, logistics and mining, covered by the National Industrial Development and Logistics Program (NIDLP), one of the pillars for achieving the Strategic Vision 2030. This program aims to make Saudi Arabia a major industrial powerhouse and a global logistics hub, focusing in particular on Industry 4.0 and local content.

The situation has begun to change, and factories are settling in the region, due to the impact of restrictive policies: the awarding of contracts is tightly linked to a local sourcing, the proportion of which varies from one sector to another.

Furthermore, in Saudi Arabia, the Minister of Transport and Logistics, inaugurated the Logistics License in 2021 in the presence of CEOs of the largest logistics companies. This license aims to develop and raise Saudi's positioning within the World Bank's Logistics Performance Index (LPI) through the services provided, improve the work in the sector and take advantage of promising investment opportunities that strengthen the local economy. It also aims to develop its connection to the international market, as well as to consolidate its strategic position among other countries as a global logistics center for trade and economic movements.

The logistics license will offer a number of advantages to its holders, as procedures will be simplified for companies that obtain the license in the sector. The aim is to attract private sector investors from within and outside Saudi Arabia.

The National Transport and Logistics Strategy also focuses on modernizing the transport system to strengthen the Saudi economy in line with the Kingdom’s Vision 2030. This includes all transport sectors such as air, sea, land and rail, enabling the Kingdom to rank among the top 10 countries in the Logistics Performance Index by 2030. In the latest 2022 rankings, Saudi has jumped 17 places to claim 38th position in the LPI. This is a rapid acceleration in the rankings - Saudi ranked 55th in 2018, amongst 160 countries, and 38th in 2022, amongst 139 countries.

Ghazi Al Malki, logistics sector expert, insists that

"Saudi will become top 10 within the LPI Index but there are improvements needed around trade facilitation, regulations, customs and infrastructure to get there."

He adds that the Kingdom has clearly demonstrated its ambition and cites numerous improvements such as average custom clearance time at 2 hours, foreign investment incentives, announcement of major infrastructure developments etc.

NIDLP in the Kingdom Of Saudi Arabia

- The primary goal of the National Industrial Development and Logistics Program (NIDLP) is to reshape Saudi Arabia into a prominent industrial force and an international hub for logistics.

- This is to be achieved through optimizing the value of its mining and energy industries and unlocking the potential of local content and the advancements of the 4th Industrial Revolution (4IR).

- NIDLP acknowledges the integral role of logistics and supply chain services within its targets and has several initiatives underway to support the attractiveness and development of these related sectors

Five Opportunities to Transform Supply Chains in the GCC

There are numerous ways in which supply chains can be transformed and the shape of these transformations depends on a variety of factors:

- External opportunities and barriers: available technologies, legislative and regulatory environment etc.

- Sector-specific drivers: level of competition, customer expectations, supplier specificities etc.

- Maturity of the company itself in terms of flow management

Irrespective of the unique factors of each transformation, there are five major areas of intervention that will allow GCC companies to adapt and seize transformative opportunities.

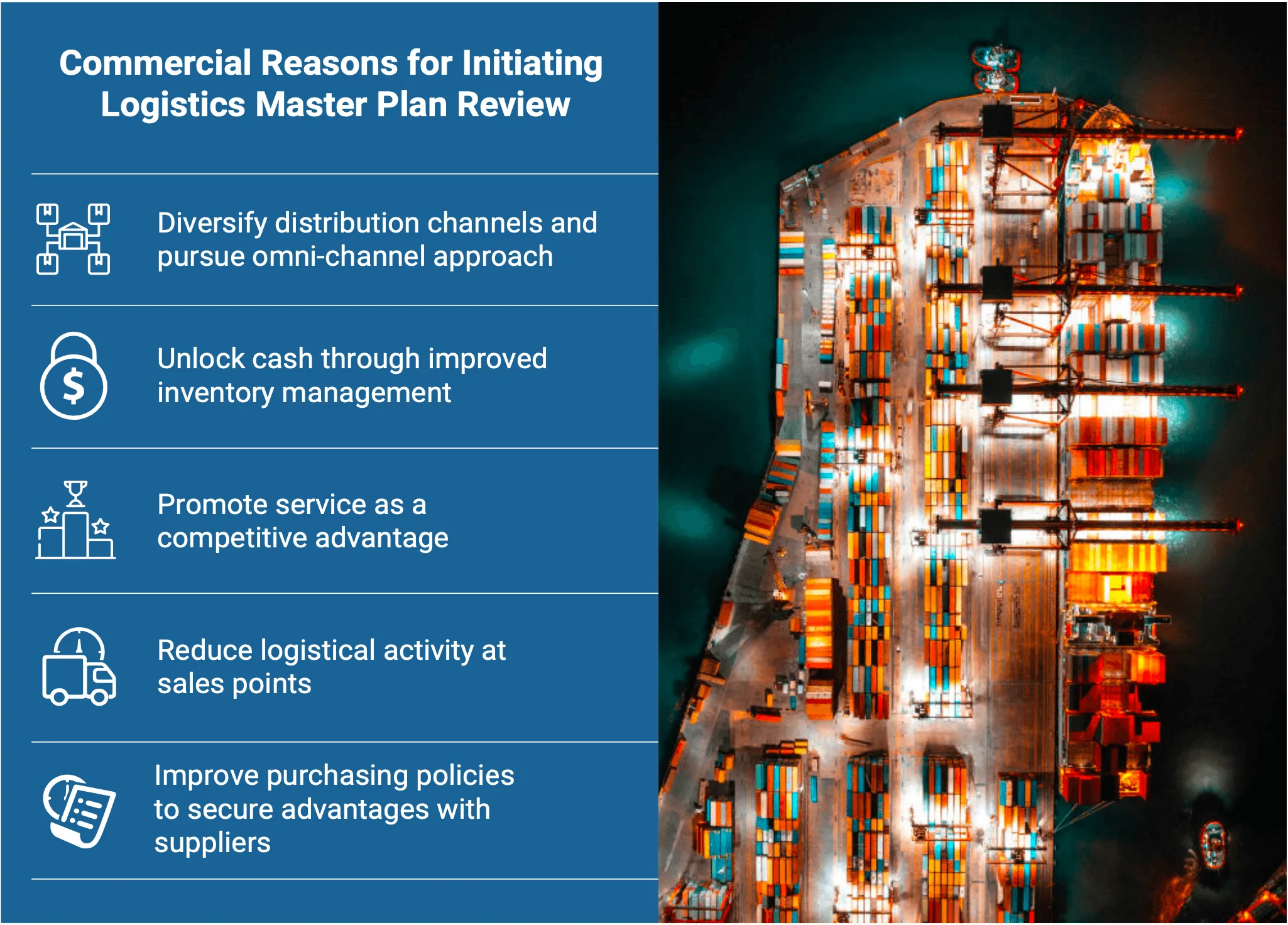

1. Reviewing Logistics Master Plans

The logistics master plan is a tool for building the future vision of flows and also represents a strategic direction for the entire organization – not just logistics – that precisely defines:

Service Level Agreements: By customer segment

Sales: Resizing of sales outlets according to stock levels and replenishment rates

Purchasing: Possible renegotiations with suppliers linked to the requested delivery locations

A logistics master plan is therefore a tool to reconsider and better prepare to meet the organization’s current and future needs by considering the upstream and downstream elements of trade

There are five key commercial reasons why an organization should initiate a logistics master plan review:

Why Create or Review Your Master Plan?

The logistics master plan is based on a vision of the forecasted evolution of distribution channels so that the proposed solution is future-proofed:

- It clarifies and updates the service level agreements services for the different customer segments: product availability, lead time, reliability of lead times, consolidation of deliveries etc

- By using network construction methodologies and decision support models, it enables possibilities and optimal scenarios to be considered for each logistics family, warehousing, transport, stock as well as information systems

- Used for the implementation of the operational management of physical flows in addition to initiating and driving change in other functions within the company: sales, marketing, purchasing, strategy etc.

2. Accompanying Organizations to a New Level of Maturity

Saudi Arabia’s Regional Headquarter’s Program (RHQ) has raised big questions around organizational transformation in the region. We can begin to see these transformations taking place – in 2021 alone, 44 companies including PepsiCo, Schlumberger, Bechtel and Boston Scientific decided that the ability to work on public tenders and with the Saudi government would commercially justify embarking on these transformations. Indeed, past experience has shown that regional headquarter moves are always an opportunity to question and improve existing organizations.

These transformations are raising questions around sharing responsibilities between the central, regional (GCC or wider EMEA) and local levels of supply chains:

- Who arbitrates the location of stocks?

- What happens and who is responsible in case of stock shortages?

- How are delivery priorities decided?

However, to create the right conditions for the development of a supply chain ecosystem, it is necessary to increase the maturity of employees working in the sector by upgrading their skills. On the one hand, it will be necessary to reduce the proportion of expatriate workers in certain countries. On the other hand, the growing demand for offsets in certain contracts will provide the opportunity for skills transfers.

GCC countries have invested massively in infrastructure. They have the latest generation of automated and robotic warehouses, and some of the most sophisticated ports and airports in the world. But there is a gap between project management to implement a new solution, and day-to- day operations management. Organizations have sometimes been restructured and in theory the reference schemes exist and the key functions have been created. But do the people in charge have the training and skills to carry out these new responsibilities? The hardest part is still to be done mobilizing the skills to make the most of the opportunities and infrastructure developed.

Organizations are becoming more complex. Local production is developing. Logistics networks are being pooled and the size of infrastructures is tending to increase, as everywhere in the world. Yet locally, supply chain training is not being adequately developed. To lead the great supply chain revolution in GCC economies, it is necessary to train and improve skills. This is even more essential since quotas of local employees are imposed in companies. Training, here or elsewhere, is still the issue for a successful professionalisation.

Deepak Patidar, Managing Director of Kanoo Terminal Services, a leading supplier of cargo support services, container-related services, transportation and reefer services in KSA and the UAE, cites skills development and training as a key issue. “Localization schemes such as Saudization is difficult to implement in some areas and there is a key issue with attaining desired skill levels in the transportation and logistics industry,” he says.

“There is an importance on increasing training to improve local skills and to be able to properly implement localization”.

Training is a key issue for a successful professionalization.

In the GCC countries, supply chain training is not developed. To lead the great supply chain revolution in the Gulf economies, it is necessary to train and improve skills. This is even more essential since quotas of local employees are imposed in companies.

The below SWOT analysis explains the high necessity in investing in employees training skills.

3. Sustainable Development

The supply chain is responsible for 20% of CO2 emissions worldwide . Therefore, the transformation of supply chains inevitably requires strategic thinking on the subjects of sustainable development and the decarbonization of logistics flows.

The GCC countries have committed to carbon neutrality by 2060 and to shift between 10% and 50% of their energy consumption to renewable energy by 2030. To date, the first concrete actions have been implemented but need to be stepped up significantly. Beyond these strong commitments, the GCC countries need to take increased tangible action in order to continue to attract investment in growth sectors such as luxury tourism, which is increasingly concerned about CSR issues.

There are four levers to pull when discussing the decarbonization of supply chains in GCC:

1. Increase the use of railways within decarbonized logistics flows

The most effective approach is to switch goods transported with fossil fuels (air, sea, road) to alternative modes of transport such as railways Rail transport of goods could replace many trucks and even part of the air transport volume between GCC countries. As the rail network is undergoing strong development within and between GCC countries, logistics organizations and public authorities must plan for increased use of this infrastructure for logistics flows.

This means positioning warehouses directly on these railways and taking freight into account in the organization of the network (instead of creating a 100% passenger transport network).

2. Preparing for the deployment of alternative fuel technologies on the road and exploring the potential of waterways

As far as low-carbon engines are concerned, although electric or hydrogen engine technologies are not yet ready (particularly for commercial usage), they must be included in the discussions today.

This means creating charging and refuelling stations for light vehicles that will be able to adapt to heavier trucks when they arrive.

Moreover, given the geography of the GCC and the proximity of the Persian Gulf and the Red Sea, boat technologies that run along the coasts with low-energy engines can also be studied to link the major cities together and thus greatly reduce the number of trucks that run along the coasts, leading to de-densifying these major routes and reducing the emissions emitted.

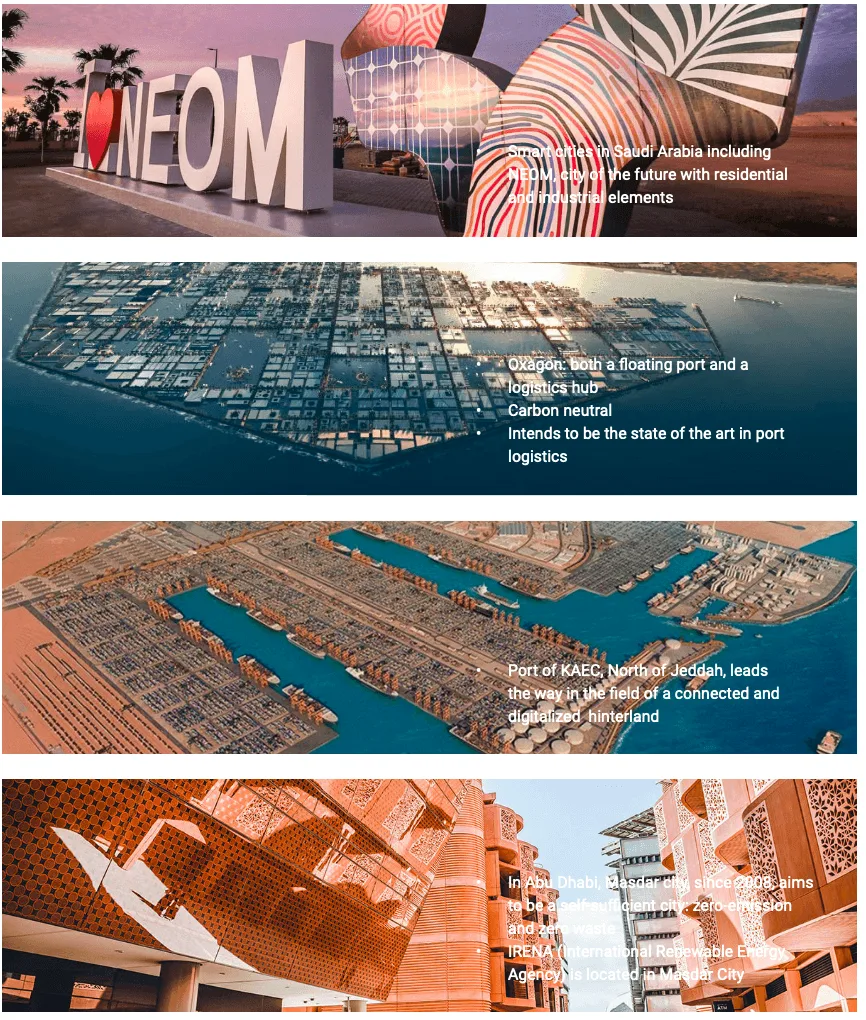

3. Sustainable urban development as an opportunity for improvements in 3PL and last-mile

The major urban centres of the GCC are becoming increasingly dense. A more sustainable development of these cities will also require an overhaul of the current logistic schemes.

Customers want to receive deliveries more often and directly to their homes, but they no longer want the associated pollution (visual, auditory, CO2 and particles) caused by trucks.

Logistics organizations will therefore have to adapt by bringing stocks closer to urban centers in order to develop alternative delivery methods that are better adapted and accepted Cities have a role to play in this transformation by developing and making available to distributors and logisticians areas on the outskirts of the city.

For more recent cities and new urban developments, developing underground cross- dock solutions to bring goods to a centralized site in the heart of the city would lead to distribute goods locally with solutions adapted to the surface climate constraints.

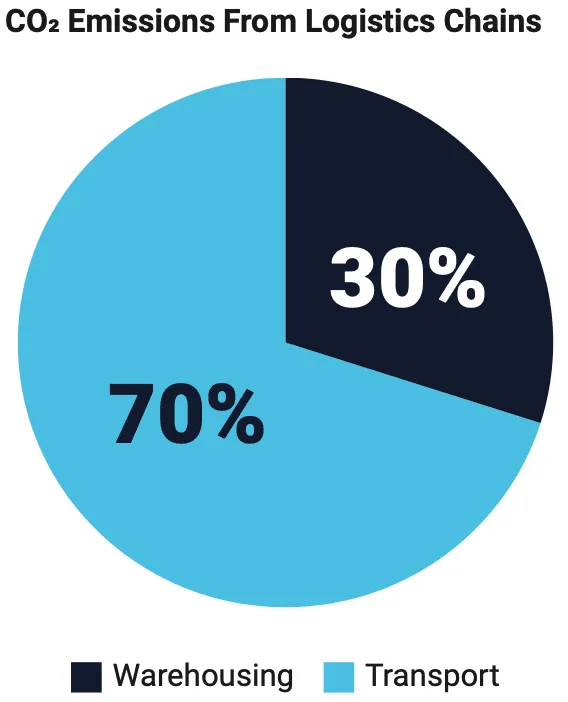

4. Warehousing

Warehouses also have a role to play in decarbonizing logistics; indeed, warehousing accounts for one third of CO2 emissions from logistics chains.

70% of CO2 emissions from a warehouse come from its construction and 30% from its use.

It is therefore important to think ‘low carbon’ from the very beginning of the project (materials built with low CO2 emissions, local materials rather than imported (or imported from less far away), etc.).

There are many ways to reduce energy consumption and CO2 emissions from warehouses during their use phase. In hot and sunny regions like the GCC, the installation of solar panels on the roof of the warehouse is the most common solution. However, other solutions such as thermal reflective roof coating, predictive temperature controls or rapid rise dock doors are also suitable for hot regions.

Inside the building, simple solutions such as LED lighting with sensors, electrical or hydrogen forklifts or collection and reuse of rainwater, zero waste to landfill, reusable totes, plastic pallets, eradicate stretch wrap, also contribute to reduce the consumption of energy and consumables and thus make the warehouse more sustainable.

Reframing Urban Logistics: Talabat

- Talabat: online food ordering company in the UAE

- Project between Talabat, Dubai Roads and Transport Authority and Dubai Integrated Economic Zones Authority

- Introduction of UAE’s first food delivery robots: “Talabot”

- The Talabot collects the food deliveries from specific restaurants and delivers within 15 minutes to customers

- First step: operate inside a gated community

Saudi Arabia’s largest Integrated Logistics Park at Jeddah Islamic Port

- The Park will offer Maersk’s clients wide infrastructure for warehousing & distribution, cold storage, e-commerce and serve as a hub for transhipments, petrochemical consolidation, air freight and LCL

- Concentration on decarbonising logistics with the reliance on renewable energy to power the whole Park.

- The Integrated Logistics Park will be completely powered by solar energy produced from solar panels covering the 65,000 square meters rooftop

- Electric trucks will be used for transportation at the Park

4. Urban Logistics: Smart Cities

Transforming supply chains also means rethinking downstream, urban and last-mile logistics. Radically innovative urban planning projects are emerging. This will undoubtedly be a real laboratory of ideas for rethinking urban logistics. Some landmark projects include:

Key challenges that affect cities include deliver issue such as addressing systems as well as unique issues with cold-chain.

In addition to traditional retail and shopping services, urban centers are increasingly affected by the development of e-commerce and its corollary, quick commerce. E-commerce will require the definition of more precise postal addresses than the existing PO Boxes. Quick commerce, if it develops, will call for dark stores, spaces dedicated to local storage in city centres that bring goods 10’ far from the consumers.

Basic and /or non-existent addressing systems, particularly in Saudi provide a unique challenge to last-mile delivery service providers. An official solution to this issue has been developed with the National Address system currently being implemented by Saudi Post. The National Address system is mandatory and requires citizens and businesses to register for a standardised address format that can also be shortened to an easy-to- remember 8 digit code.

Alongside the National Address system, there is another complimentary system that has already been adopted by many logistics and fulfilment companies across the globe. what3words, a UK based tech firm, has created a geocode system that has divided the globe into a grid of 3m x 3m squares, and assigned each square a unique combination of three words: a what3words address. This means every gate, mall entrance, parking spot, and point along an unmarked road has its own unique address made up of just three words, enabling users to easily find, share and navigate to precise locations, anywhere in the world.

Quentin Hicks, Director at what3words, comments

‘One of the biggest challenges facing e-commerce businesses globally is inaccurate addressing, and often the issue is particularly acute outside of major urban hubs. what3words provides a simple solution, enabling a slick last-mile delivery experience for customer and courier alike, which is why it has been adopted at pace by businesses across the Kingdom’.

Around 20 logistics providers have adopted what3words as an addressing system in the Kingdom. The platform is available in Arabic and 53 other languages creating a seamless user experience for drivers and operators from any country. A growing number of retailers are using what3words at checkouts to arrange deliveries for customers – a task that was previously complicated. ROSHN, the Kingdom’s leading national real estate developer (owned by the PIF), will adopt what3words addresses in all the communities it will develop in the Kingdom.

The addressing challenge does not only impact urban areas and the last- mile. In fact, what3words’ solution has been applied to a variety of other use cases. Remote assistance can be sought for railway incidents and life-saving emergency responses can be co-ordinated with the Saudi Red Crescent. What3words growth in the Kingdom demonstrates the potential for innovation and private-sector participation in solving structural issues across the supply-chain.

5. Operational Excellence

Companies across the GCC have previously been able to generate profitability due to market-driven advantages and benefits. What will determine future profitable success will be a push to optimize and improve operations.

COVID-19 Impact

The pandemic has had a significant impact on operations and their costs. Because of COVID-19, many supply chain networks were suspended which caused a decrease in the supply versus the demand and consequently increased the costs.

Fluctuations in oil and gas prices over this time period have also had a major impact on profitability. Companies have added pressure to find ways to remain sustainable.

A Push Towards Operational Excellence

Operational excellence has the power to lower operational risk, lower operating costs and increase revenues relative to competition and create additional value for customers and shareholders. Operational excellence can create more efficient and agile operating systems and impacts two major pillars within organizations:

- Service Rates: We insist on the service rate because “client is king” and having a high service means that products are delivered at the right time and place ; this could not be done without reviewing the whole supply chain starting from the port to the warehouse, and then to the client (and the opposite way when we talk about exports)

- Technology Systems: Today, all these processes can be optimized, accelerated, smoothed be most cost- effective, using new technologies. For example, RTTV (Real Time Tracking Visibility technology) could track the location and status of the containers, helping the company to identify a problem very much upstream and take the corrective action at the right moment.

The Authors

Damien Duhamel

Damien Duhamel

Managing Partner, Eurogroup Consulting Middle East

Jack Fowler

Jack Fowler

Director, Eurogroup Consulting Middle East

Noura Stouhi

Noura Stouhi

Consultant, Eurogroup Consulting Middle East

Philippe-Pierre Dornier

Philippe-Pierre Dornier

President, Newton. Vauréal Consulting, Professor at ESSEC

Pierre-Alexandre Matringe

Pierre-Alexandre Matringe

Manager, Newton. Vauréal Consulting