E-commerce Logistics in Saudi Arabia: Meeting the Demands of a Booming Market

As e-commerce takes hold across Saudi Arabia, the logistics industry is adapting rapidly to meet the unique demands of this fast-growing sector. With the Saudi Arabian e-commerce market projected to reach $14.38 billion in 2024 and climb to $24.29 billion by 2029, logistics providers are innovating to keep up with increased consumer expectations. This growth is reshaping e-commerce logistics, especially in the area of last-mile delivery, as companies strive to provide faster, more reliable service.

How E-commerce Growth is Reshaping Logistics

Saudi Arabia’s e-commerce expansion has been driven by several factors: increased internet penetration, a tech-savvy population, and a surge in smartphone use. Government initiatives under Vision 2030, which aim to diversify the economy and encourage digital transformation, are also key contributors. As a result, the demand for efficient e-commerce logistics solutions has intensified.

For logistics providers, this means upgrading systems and streamlining operations to handle more orders while maintaining high levels of customer satisfaction. With such exponential growth in online shopping, logistics companies are focusing on optimizing inventory management, warehousing, and—most critically—last-mile delivery. Last-mile delivery, which is the final step of the delivery process, has become a crucial factor in shaping customer experiences in e-commerce.

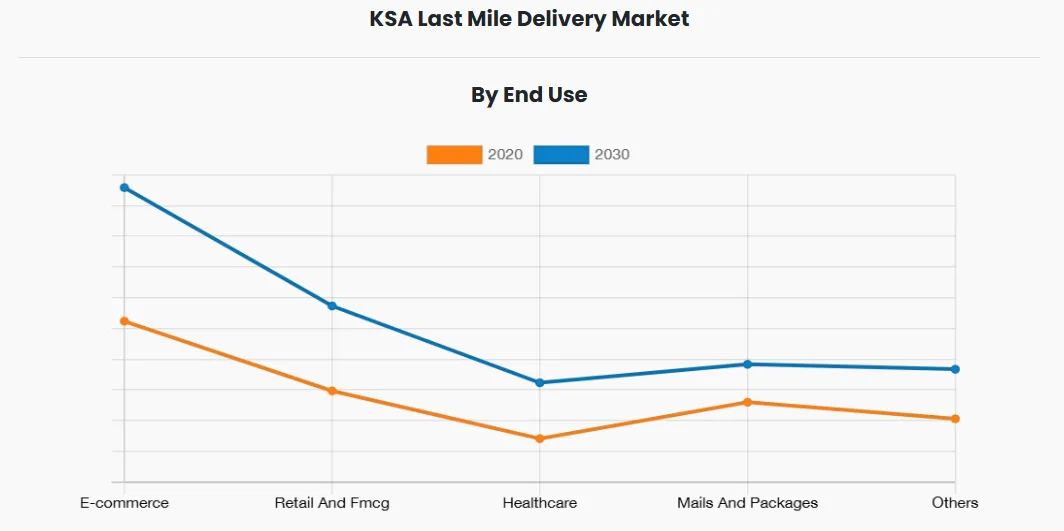

The Role and Growth of Last-Mile Delivery

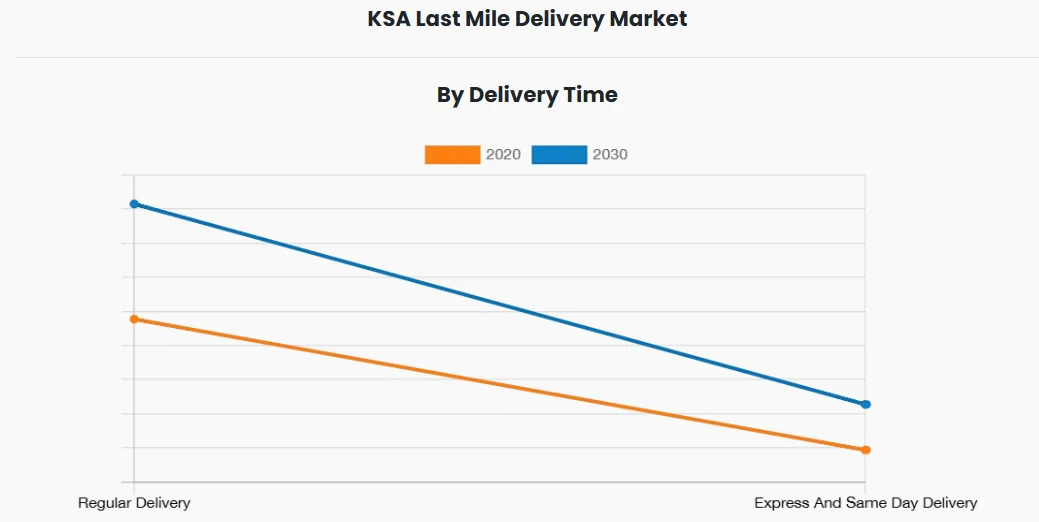

Last-mile delivery has seen significant growth in Saudi Arabia. In 2020, the market was valued at $285.3 million, and it’s expected to reach $520.9 million by 2030, with a compound annual growth rate (CAGR) of 6.3%. This stage in the delivery process is often the most expensive and challenging due to the need for speed, accuracy, and flexibility. As consumers increasingly expect fast, reliable deliveries, logistics providers in Saudi Arabia are under pressure to find innovative ways to meet these demands efficiently.

In an e-commerce landscape that’s expanding this quickly, last-mile delivery can make or break a customer’s experience. With the surge in orders, companies are adopting various strategies to streamline last-mile logistics, including partnerships with local delivery firms, expanding warehousing networks, and implementing technology that optimizes delivery routes in real time.

Challenges in E-commerce Logistics

Despite the rapid growth, e-commerce logistics in Saudi Arabia faces unique challenges:

- Geographic Spread: The vast territory and diverse topography of Saudi Arabia mean that delivering to remote areas can be complex and costly. Unlike urban centers, rural and distant regions often lack the infrastructure needed for efficient logistics.

- Consumer Expectations for Speed: With e-commerce giants setting high standards, consumers have come to expect faster delivery times. Meeting these expectations while managing costs is challenging, especially in a country where the infrastructure is still evolving.

- Increasing Order Volumes: The growth of e-commerce has led to an influx of orders, placing additional strain on logistics providers and making effective resource allocation essential.

Innovative Solutions Shaping Saudi Logistics

To overcome these challenges, logistics companies in Saudi Arabia are implementing advanced solutions that improve efficiency and customer satisfaction:

- Technology Integration: Many companies are integrating GPS tracking, automated warehousing, and AI-powered route optimization software to improve delivery times and reduce errors. These tools not only help manage increased order volumes but also allow for real-time tracking, which enhances transparency and customer confidence.

- Alternative Delivery Methods: With the rise in demand, companies are exploring alternative delivery options, such as drones and parcel lockers, to serve hard-to-reach areas and increase delivery flexibility. This is particularly beneficial in remote regions and urban areas with heavy traffic.

- Partnerships and Collaboration: By forming partnerships with local companies, larger logistics firms are able to extend their reach and take advantage of existing networks. For example, collaborating with smaller local couriers allows larger companies to ensure faster deliveries, even in less accessible areas.

Government Support and Vision 2030

The Saudi government’s Vision 2030 initiative is also bolstering the logistics industry. As part of this national plan to diversify the economy, the government is investing in digital infrastructure, regulatory reforms, and the creation of logistics hubs across the country. These efforts aim to streamline operations for e-commerce companies and their logistics partners, helping Saudi Arabia become a regional e-commerce hub.

By supporting infrastructure improvements, the government is paving the way for logistics advancements that directly benefit the e-commerce sector. Investments in highways, ports, and technology are making it easier for logistics companies to scale, reduce delivery times, and reach a broader customer base.

The Future of E-commerce Logistics in Saudi Arabia

With e-commerce projected to reach $24.29 billion by 2029, Saudi Arabia’s logistics sector, especially last-mile delivery, will remain a cornerstone of the country’s digital transformation. Companies that adopt advanced technology, respond to consumer expectations, and find innovative ways to overcome logistical challenges will be well-positioned to lead in this competitive environment.

In a landscape where consumer expectations are continually rising, the interplay between e-commerce growth and logistics innovation offers exciting potential. Saudi Arabia’s logistics providers have an opportunity not only to expand but to redefine e-commerce logistics standards in the region, setting new benchmarks for efficiency and customer satisfaction in the digital age.